Precious metals are apparently waking up. And here is where you can find the best deals.

Site:

Precious metals news

Bond investors are increasingly wary of banks heavily involved in commercial real estate, leading to wider spreads on these banks' bonds as concerns grow over the impact of property debt on the financial system. Barclays Plc analysts, led by Dominique Toublan, have observed that banks with significant commercial property investments face higher costs of borrowing due to these widened spreads. This trend is notable even as there's a general rush towards financial industry bonds for their higher yields. Toublan points out that commercial real estate concerns are a major factor affecting bond spreads, accounting for about 80% of the variation in spreads among issuers in the U.S. investment-grade debt market.

The United Arab Emirates is advancing efforts to enhance transparency and ethical practices in gold transactions, especially those conducted through online platforms. This initiative, led by the World Gold Council (WGC), aims to empower consumers with the knowledge needed to make informed purchases and to ensure the credibility of selling entities.

Silver prices experienced a notable surge of over 4% in a single week, fueled by speculations of an impending U.S. interest rate cut. This anticipation was stirred by a downturn in U.S. manufacturing activity and a dip in consumer confidence, suggesting softer economic conditions that might prompt the Federal Reserve to adjust its monetary policy.

Why Britain Is Still Paying the Price for Gordon Brown’s Gold Bullion Blunder

Why Britain Is Still Paying the Price for Gordon Brown’s Gold Bullion BlunderMar 5, 2024 - 11:36:33 PST

It has been considered one of the worst financial blunders the Government ever made... Telegraph Money reveals what went wrong 25 years ago – and outlines the repercussions.

In January 2024, central banks significantly bolstered their gold reserves, adding 39 tonnes to the global tally, with Turkey and China leading the acquisitions. This marked a robust start to the year, continuing a trend from 2023, which, although slightly below the record-setting pace of 2022, remained impressively strong. Such purchases have become a crucial factor in supporting the gold market. This ongoing interest from central banks is driven by persistent and, in some cases, intensifying factors that are expected to maintain or even increase their demand for gold throughout 2024.

Oil prices experienced volatility, finding some stability through technical support despite a general trend of risk aversion in broader financial markets. West Texas Intermediate (WTI) oil saw a minor decline of 0.4%, dropping below $79 per barrel amidst market fluctuations influenced by mixed economic signals and anticipation of Federal Reserve Chair Jerome Powell's congressional testimony. The crude oil market found a semblance of support around its 200-day moving average, which acted as a barrier against further drops.

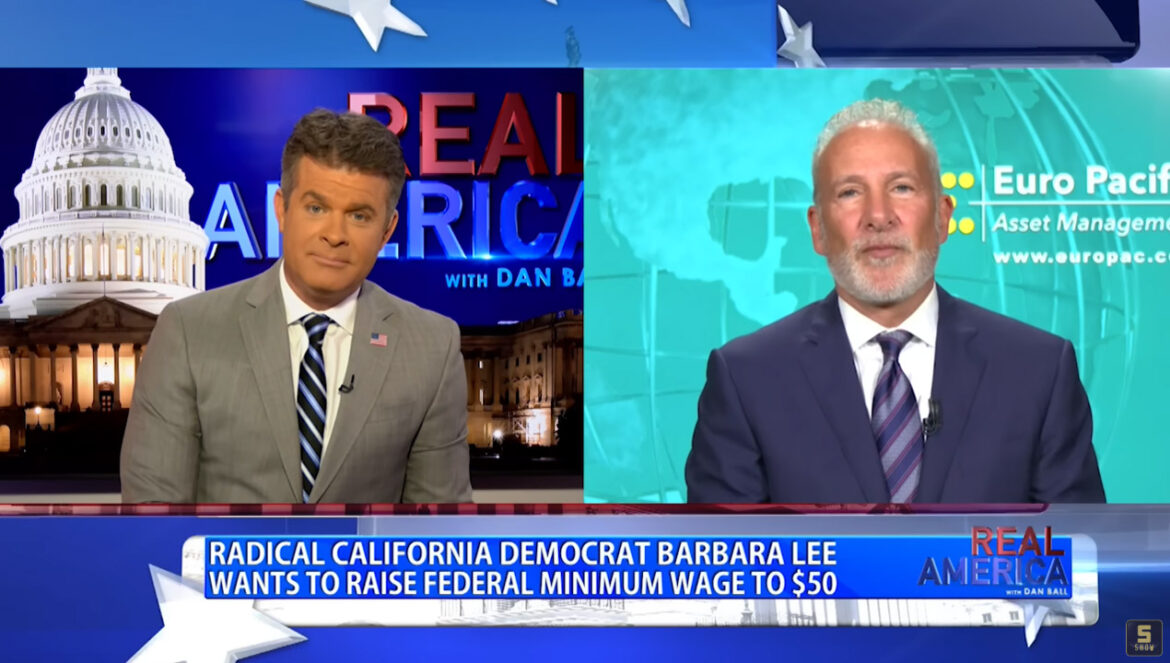

New Peter Schiff Interview: California Dooms Workers and Congress Kicks the Can Down the Road

New Peter Schiff Interview: California Dooms Workers and Congress Kicks the Can Down the RoadMarch 5, 2024

Peter recently appeared on OAN’s Real America with Dan Ball to discuss the minimum wage, government spending, and inflation. He first points out the blatant corruption of the California state government, which recently passed a $20 minimum wage for all fast-food restaurants except those that bake their own bread. The state’s governor, Gavin Newsom, has received several large campaign donations from the owner of many Panera Bread franchises in California, causing Newsom’s critics to question the motives of such an exception. Peter also points out that, under Newsom’s logic, such an exemption will actually hurt Panera’s employees. If minimum wages are so helpful to workers, why exempt Panera at all?

Gold prices have hit new highs, with futures hitting new records and analysts optimistic about the precious metal's trajectory. Even as spot gold trades higher, analysts from Citi highlight that, adjusted for inflation, gold's current prices are still below historic highs. Nevertheless, Citi analysts maintain a positive outlook, suggesting a 25% chance gold could average around $2,300 per ounce in the latter half of the year, with a more conservative estimate at $2,150. They also entertain a possibility of gold hitting an extraordinary $3,000 per ounce in the next 12 to 16 months.

Record-Breaking Rally: Gold Prices Soar on Economic Easing and Safe-Haven Demand

Record-Breaking Rally: Gold Prices Soar on Economic Easing and Safe-Haven DemandMar 5, 2024 - 09:26:18 PST

Gold soared to an all-time high on Tuesday, driven by anticipation of relaxed U.S. monetary policies and ongoing global tensions. This surge is supported by a robust foundation: heightened physical demand in Asia, consistent central bank acquisitions, and gold's enduring appeal as a safe haven. Central banks have consistently added to their gold reserves for eight consecutive months, underlining the metal's attractiveness. The price of spot gold climbed 0.8%, reaching $2,130.79 per ounce and briefly peaking at $2,141.59, signaling strong momentum that may continue to lift gold's value.

Despite the U.S. stock market reaching all-time highs, the average American remains pessimistic, a situation that is seen as unhealthy for both the stock market and the economy. Critics argue that consumer pessimism is unwarranted, given the near 50-year low unemployment rates and significantly reduced inflation compared to two years ago. However, a new study challenges this view by suggesting that if inflation were accurately measured, it would reveal the extent of the financial strain on consumers. This study supports the notion if the CPI fully reflected higher borrowing costs, it would have peaked at 18% in November 2022 and still be around 8%.

Gasoline prices in the U.S. are undergoing significant increases due to recent constraints on refinery operations and rising oil prices. As of Monday, the national average price for a gallon of gas was $3.35, marking a $0.09 increase from the previous week, yet it remains $0.05 cheaper than this time last year, according to AAA. The challenges facing U.S. refineries include severe weather conditions and power outages at critical facilities. Tom Kloza, the global head of energy analysis at OPIS, informed Yahoo Finance that these disruptions could soon push retail gas prices above those recorded a year ago. This situation highlights the fragile balance in the gasoline market, where supply disruptions and fluctuating oil prices can quickly lead to higher costs for consumers.

From precious metals to the stock market, Alan breaks down the key events shaping your financial future.

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal's price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold prices was notably recorded without the typical surge in public buying that usually accompanies such milestones. Instead, there has been a consistent outflow from gold ETFs, suggesting that the retail sector has been selling rather than accumulating during this rally.

In a bit more than four hours, Bitcoin lost nearly $10,000. While Bitcoin is up from its lows of the day, the Bitcoin Mining Stocks continued to get taken to the woodshed. Marathon Digital, the largest Bitcoin miner, saw its share price decline another 13% today...

US Housing Market Shows Life, Yet Overvaluation Clouds Recovery, Fitch Reports

US Housing Market Shows Life, Yet Overvaluation Clouds Recovery, Fitch ReportsMar 4, 2024 - 13:22:37 PST

The US housing market is beginning to show signs of recovery with an increase in sales and inventory, yet challenges persist due to significant overvaluation, according to Fitch Ratings. Despite a positive shift in market dynamics, the effects of last year's price surge have exacerbated the issue, with homes being overvalued by an average of 11.1% across 91% of US metropolitan areas as of the third quarter. This trend of overvaluation is expected to have persisted through the end of the last year, as prices continued to rise into the fourth quarter. Fitch's analysis underscores the ongoing imbalance in the housing market, highlighting the need for caution among buyers and investors.

Mar 4, 2024 - 11:13:43 PST

The London Bullion Market Association (LBMA) reported that the London gold price benchmark reached a new all-time high of $2,083.15 per troy ounce during a morning auction on Monday, eclipsing the former record of $2,078.40 set on December 28. The LBMA plays a crucial role in the global gold market, certifying gold refiners and granting them access to the London bullion market, which is recognized as the largest in the world. The LBMA Gold Price serves as the worldwide benchmark price for unallocated gold delivered in London, making this record-setting price a significant event in the gold market, reflecting its current strength and investor interest.

Recent reports from various international media outlets have highlighted a trend among the world's wealthiest individuals, including high-profile figures like Meta's Mark Zuckerberg and entrepreneur Elon Musk, preparing for catastrophic scenarios by building massive bunkers stocked with food and significant quantities of gold. According to The Daily Star, Zuckerberg has initiated plans for a substantial bunker in Hawaii, sparking commentary from figures like Christina Randall. Randall suggests that such preparations among the elite signal a readiness for events akin to "Bible Prophecy," implying a grim outlook for the future and a divide between the rich and the general populace.

Oil prices experienced a slight decline on Monday, despite OPEC+ announcing an extension of its voluntary output cuts through the middle of the year. This decision, aimed at stabilizing the market amidst global economic uncertainties and increased production outside the OPEC+ group, did not offset the dampening effects of warm winter weather on demand. Brent futures dropped 81 cents to $82.74 a barrel, and U.S. West Texas Intermediate (WTI) decreased by $1.20 to $78.77 a barrel, despite both experiencing gains in the previous week. The continuation of the 2.2 million barrels per day cuts by OPEC+ reflects the complex interplay between production decisions and fluctuating demand factors in the global oil market.

John Authers explains why a sustained rally for gold above $2,100 would need rate cuts. But there are increasingly sound reasons why they might not happen.

The US economy's resilience has led to a reassessment of expectations for interest rate cuts in 2024. Initially, after enduring prolonged inflation and increased borrowing costs for over 20 months, there was widespread anticipation among investors, economists, and Federal Reserve officials that the economy would weaken, enabling the Fed to commence rate reductions. However, the anticipated timeline for a Federal Reserve policy shift continues to be postponed. Despite early market predictions of six rate cuts starting in March 2024, this prospect has now been deemed unlikely. The economy's unexpected strength suggests that any immediate relief in the form of rate cuts may not materialize as previously hoped.