Gold has all the potential to go unprecedentedly high. But silver will be gold on

Site:

Precious metals news

IMF Says Risks to Financial Stability Have Increased, Calls for Vigilance

IMF Says Risks to Financial Stability Have Increased, Calls for VigilanceMar 27, 2023 - 05:32:04 PDT

International Monetary Fund chief Kristalina Georgieva said on Sunday that risks to financial stability have increased and called for continued vigilance although actions by advanced economies have calmed market stress.

Data show worrisome trends in real estate, banks and private markets. The sudden collapse of Silicon Valley Bank was driven in part by assets that lost value when interest rates rose from near zero. Higher rates will continue to weigh on banks’ balance sheets. They will also cause problems in other parts of the economy.

Credit Suisse Accessed Billions in Liquidity Last Weekend, Swiss Finance Minister Says

Credit Suisse Accessed Billions in Liquidity Last Weekend, Swiss Finance Minister SaysMar 27, 2023 - 05:29:04 PDT

Credit Suisse tapped the Swiss National Bank for "a large multi-billion amount" last weekend to secure its liquidity, the country's finance minister Karin Keller-Sutter told Swiss broadcaster SRF on Saturday.

(Bloomberg) -- Investors are quickly dividing corporate borrowers into the haves and the have-nots.Most Read from BloombergSaudi National Bank Chair Resigns After Credit Suisse RemarkFirst Citizens Nears Deal to Buy Silicon Valley Bank, Sources SayFirst Citizens Buys Silicon Valley Bank After Run on LenderBond Traders Go All-In on US Recession Bets That Defy...

U.S. authorities are considering the expansion of an emergency lending facility that would offer banks more support, in an effort that could give First Republic Bank more time to shore up its balance sheet, Bloomberg News reported on Saturday.

The banking crisis set off by the collapse of SVB has exposed a disconnect: Bankers want more aggressive action to shore up the industry, while regulators argue they've done what they can within the limits of the law.

Nearly $100 Billion in Deposits Pulled From Banks; Officials Call System ‘Sound and Resilient'

Nearly $100 Billion in Deposits Pulled From Banks; Officials Call System ‘Sound and Resilient'Mar 27, 2023 - 05:23:04 PDT

Regulators again assured the public that the system is safe, as data showed customers pulled nearly $100 billion in deposits.

An executive who also serves on the board overseeing the New York Federal Reserve warned on Twitter of potentially systemic problems in the real estate finance market and called on the industry to work with authorities to avoid things getting out of hand.

Rising interest rates have exposed the problem with building a strategy around serving wealthy clients.

Worries about the German lender risk becoming a self-fulfilling prophecy as investors search for the next weak link in European banking after Credit Suisse.

U.S. stock futures rose on Monday, after First Citizens BancShares helped calm unsettled markets by saying that it would take the deposits and loans of failed Silicon Valley Bank. The deal offered markets some respite after weeks of turmoil set off by the collapse of tech-focused SVB earlier this month and punctuated by more bank failures and rescues orchestrated by...

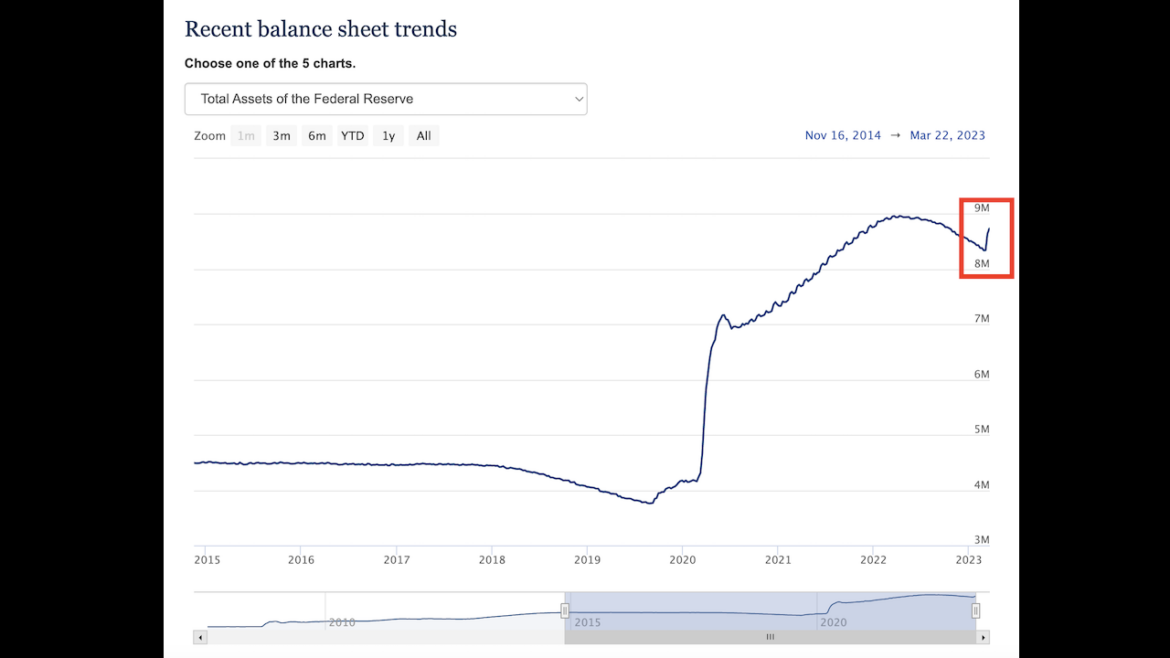

In the week before it raised interest rates another 25 basis points to fight inflation, the Federal Reserve added more than $94 billion to its balance sheet. This was on top of the nearly $300 billion it piled onto the balance sheet in the first week of its bank bailout.The balance sheet reveals that Fed has loaned banks nearly $400 billion in money created out of thin air in just two weeks.

Peter Schiff: This Is a Sequel to 2008 and Like All Sequels It Will Be Worse Than the Original

Peter Schiff: This Is a Sequel to 2008 and Like All Sequels It Will Be Worse Than the OriginalMarch 27, 2023

Peter Schiff appeared on Real America with Dan Ball to talk about the bank bailout, the unfolding financial crisis, the Fed and inflation. He said this is a sequel to 2008 and like all sequels, it's going to be worse.

Gold is wrapping up March, which is a minor delivery month. While it was a decent delivery month, it was the smallest minor month since November 2021.

ARE TRADERS & THE MARKET BETTING ON MUCH HIGHER GOLD PRICES? The Key Breakout Price Is $2,000

ARE TRADERS & THE MARKET BETTING ON MUCH HIGHER GOLD PRICES? The Key Breakout Price Is $2,000March 26, 2023

Traders and the Market are preparing for much higher gold prices as bullish bets on gold hit record highs. But, is this a good sign? We will see, especially if the banking crisis continues to spread throughout the world in the following weeks and months...

A long-term gold valuation model, which assumes gold will account for the majority of international reserves, suggests the gold price to exceed $8,000 in the coming decade.

Mar 24, 2023 - 13:12:07 PDT

Gold and silver prices rallied Thursday, scoring settlement highs that reached more than a year for gold and to seven weeks for silver. Up for a third time this week, gold for April delivery tacked on $46.30, or 2.4%, to close at $1,995.90 an ounce on the Comex division of the New York Mercantile Exchange.

"It's Getting Real": Unease Over Banking Sector Turmoil Spurs Huge Demand For Physical Precious Metals

"It's Getting Real": Unease Over Banking Sector Turmoil Spurs Huge Demand For Physical Precious MetalsMar 24, 2023 - 13:10:29 PDT

Once regarded as a “barbarous relic” by the Wall Street financial sector, gold and silver are now in heavy demand to hedge against inflation and financial risk.

So far, the commodity market’s reaction has gone down different routes with precious metals rallying as they benefitted from collapsing yields and safe-haven demand.

Mar 24, 2023 - 12:59:04 PDT

Booth also provides her economic outlook, and suggests that investors can "be bold" in allocating more than 10% of their portfolio to gold, which she forecasts will rise in the midst of ongoing financial stress.