Gold has all the potential to go unprecedentedly high. But silver will be gold on

Site:

Precious metals news

US job growth for the year through March is expected to significantly underperform previous estimates, with a potential shortfall of 500,000 jobs. JPMorgan Chase & Co. predicts a substantial downward revision to the March employment figures. This weaker outlook contrasts sharply with last year's optimistic employment data, which influenced the Federal Reserve's aggressive interest-rate hikes. Discrepancies in the data suggest the labor market may not be as robust as previously believed, casting doubt on the US economic outlook and potentially stalling future rate hikes.

Germany experienced its sharpest decline in activity since May 2020, and France saw its third consecutive monthly drop in output. The euro area is projected to contract by 0.2% in Q3. These dismal figures suggest the economy is struggling, causing the 10-year German yield to plummet. The likelihood of an ECB rate hike next month has decreased from 55% to 40%.

More Banks Get Credit Downgrades as Financial Crisis Continues to Bubble Under the Surface

More Banks Get Credit Downgrades as Financial Crisis Continues to Bubble Under the SurfaceAugust 23, 2023

The financial crisis precipitated by rising interest rates continues to bubble under the surface.Earlier this month, Moody’s cut the credit rating of 10 small and midsize banks. It also placed six large banks on review for potential downgrades and revised 11 more banks from a stable outlook to a negative outlook.This week, S&P Global followed Moody's lead and downgraded the credit ratings of five banks. It also lowered the outlook for several others

The BRICS summit is underway with talk of expanding the economic block and speculation about a "new currency." Peter Schiff appeared on Real America with Dan Ball to talk about these developments, saying the BRICS nations will blunt Western dominance.

The national debt has climbed to a staggering $32.7 trillion. In just the first two months after Congress reached a deal and suspended the debt ceiling for two years, the national debt surged by $1.2 trillion.And there is no end in sight.

Since price inflation took off in the wake of pandemic-era stimulus, Americans have blown through their savings and run up their credit cards to make ends meet. Now they're starting to have a hard time paying those credit card bills.The number of Americans rolling credit card debt from month to month is now higher than the number of people paying their bills in full for the first time ever.

Gold futures rose on Tuesday, bolstered by a dip in U.S. 10-year Treasury yields. As analysts see signs of stabilization in gold prices, all eyes are on Federal Reserve Chairman Jerome Powell's upcoming speech. Any insights on monetary policy developments, especially after recent uncertainty from the Federal Reserve's minutes, could influence gold's trajectory. Economic data on the U.S. job market and inflation will also play a crucial role in determining gold's performance.

Despite a recent 12% dip in silver prices influenced by economic factors, the metal remains a hot commodity. Earlier this year, silver saw a surge, especially driven by industrial demand in China. Importantly, global silver demand consistently outpaces supply. Technological advancements and consumer behavior changes have opened new markets for silver, particularly in electrification and jewelry. Indian demand for silverware and jewelry soared last year, reflecting robust economic recovery. Looking forward, silver's appeal is poised to stay resilient, with potential supply shortages and consistent global demand lending optimism to its market value.

Despite warnings since April 2022, the U.S. economy looks robust. However, concerns persist:

1. **Federal Reserve's Interest Rate Hikes:** There's been a steep increase from near zero to 5.5% in 16 months. Although immediate repercussions haven't been evident, such rapid hikes typically have delayed negative effects.

2. **Inflation and Spending:** Even if inflation seems controlled, cumulative price hikes since the pandemic's onset could eventually curtail consumer spending.

3. **Industrial Decline:** Industrial production is trending downward, signaling potential broader economic issues.

4. **Bank Lending Standards:** Over half of banks are tightening lending standards for businesses, which can hamper growth and employment.

5. **Inverted Treasury Yield Curve:** This typically precedes a recession. The curve has been inverted since last year, hinting at investor concerns.

6. **Market Overconfidence:** Current market strength might be deceptive, overshadowing looming economic challenges.

The housing market is displaying alarming signs reminiscent of the catastrophic 2008 crash. Notable warning signs include:

1. **Unsustainable Price Spikes**: Rapid housing price surges may indicate a looming bubble. Current trends suggest that prices are plateauing after such increases.

2. **Risky Mortgage Practices**: An uptick in high-risk lending, such as subprime mortgages, echoes the irresponsible lending seen prior to the 2008 crash. These risky loans contributed significantly to the previous economic collapse.

3. **Rising Mortgage Rates**: As rates climb, demand for properties may decline, leading to a potential drop in home prices.

4. **Speculative Buying & Overbuilding**: An influx of speculative property buying and excessive construction can lead to market oversupply, pushing prices down.

5. **Economic Downturn**: A weakened economy, marked by reduced disposable income and job losses, hampers housing demand. Recent surveys show declining consumer confidence in the housing market.

In July, existing home sales plummeted more than expected, marking a 2.2% month-over-month decline and a stark 16.6% decrease year-over-year. This drop is the worst since 2010 and even surpasses the lows during the COVID lockdowns. NAR Chief Economist Lawrence Yun highlighted that inventory availability and mortgage rates have negatively impacted buyers. Builders have tried to boost sales through various means, but their efforts are running short. A concerning trend suggests that new home prices may soon dip below existing home prices, a phenomenon last observed during the 2005 housing bubble. There's a significant disparity between homebuyer and homebuilder confidence, and with mortgage rates as an indicator, the market may face further turmoil.

The Wall Street Journal suggests a shift in the Federal Reserve's focus towards higher inflation targets. While current efforts aim to stabilize inflation below 3%, a target above 2% might be more beneficial as it could help cushion the economy against severe downturns. This, however, raises concerns about the real benefits of inflation. Historically, routine consumer price deflation has been seen as beneficial. However, central bankers' attempts to combat it have resulted in damaging asset bubbles. Economists often overlook asset inflation, focusing primarily on consumer inflation, leading to continuous problems. The debate around inflation expectations is also under scrutiny, with many viewing it as a flawed theory. Despite these criticisms, there's a push for higher inflation targets, echoing similar "temporary" measures in the past, such as Nixon abandoning the gold standard in 1971. This shift emphasizes the ongoing value of gold in turbulent economic times.

Deflation followed by inflation ultimately results in long-term inflation. The value diminishes when liquidity is scarce, so one needs resilience to weather financial storms. Quick financial maneuvers might be overly optimistic given the unpredictable market ahead. The current Consumer Price Index (CPI) doesn't reflect true inflation and has been adjusted over the years to depict a more controlled economic scenario. This manipulation means that actual living costs due to inflation are likely much higher than reported. Having assets that hold their value is important.

The U.S. and Europe's decreasing CPI inflation, termed the "Great Phony Postpandemic Disinflation," isn't due to central bank policies but natural post-pandemic dynamics. Despite the Fed's "success" celebrations, the dollar's value has decreased since the pandemic's onset. Recent monetary conditions indicate hidden inflation risks, with the post-pandemic period showing signs of asset inflation. As 2023 progresses, there's growing concern about the return of glaring monetary inflation and the potential shift from asset inflation to deflation, exacerbated by geopolitical tensions and fluctuating trade. The Fed's pivotal role in global financial stability remains evident.

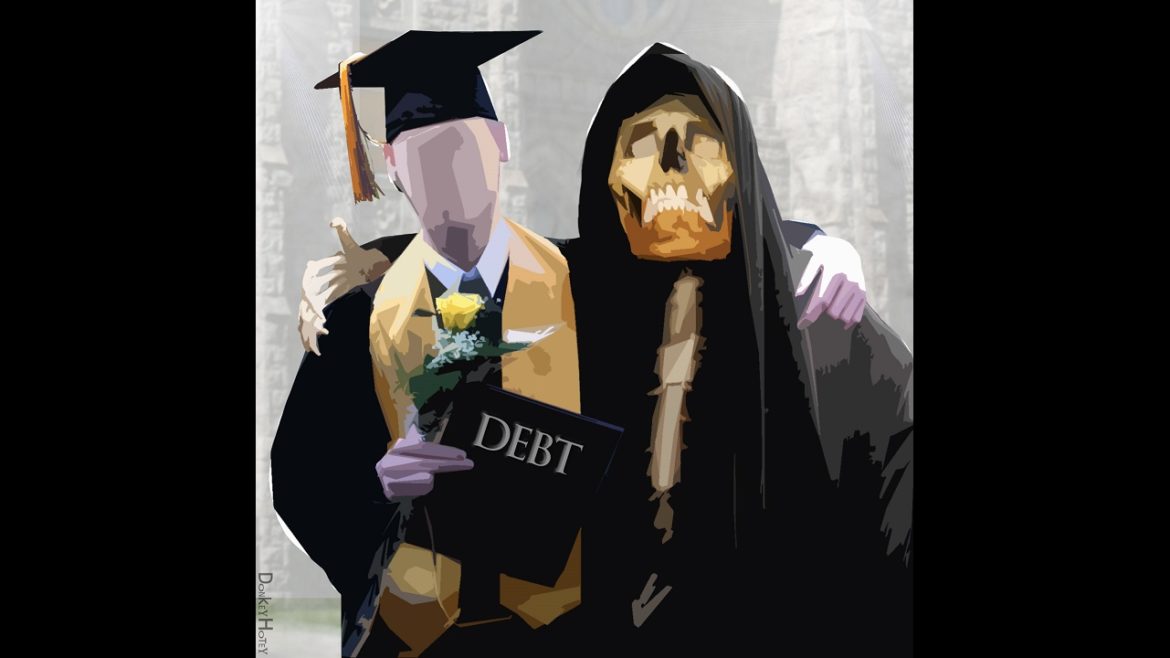

The more than three-year break from student loan payments is about to end. That's more bad news for an economy that depends on consumer spending.Interest accrual on student loans will restart on September first with payments resuming Oct. 1.

A recent Allianz survey reveals that 61% of middle-class Americans fear running out of savings in retirement more than death. The study, which gathered responses from 1,000 individuals aged 25 and up, defined the middle class based on investable assets or annual income. This significant apprehension emphasizes the role of Social Security in ensuring financial stability during one's golden years. Alarmingly, 56% see recurring "financial crises" as a norm in retirement planning, with 46% saying their retirement strategies have been affected by the crisis starting in March 2020.

Housing Market Affordability Now Worse Than at the Height of the Housing Bubble in 2006

Housing Market Affordability Now Worse Than at the Height of the Housing Bubble in 2006Aug 22, 2023 - 06:37:42 PDT

August 2023 has been marked as the most challenging month for housing affordability this century, with average 30-year fixed mortgage rates skyrocketing to 7.48%, a peak not seen since 2000. The Atlanta Fed's data shows housing affordability plunging even before this recent hike, surpassing the lows of the 2006 housing bubble. This crisis has roots in the last year when mortgage rates leaped from 3% to over 7%. When combined with a 40% spike in U.S. home prices during the Pandemic Housing Boom in just two years, the nation faces unprecedented housing unaffordability.

Credit card interest rates are near 40-year highs, leading to Americans accumulating record amounts of debt, J.D. Power's survey suggests. Data reveals Americans have amassed over $1 trillion in credit card debt for the first time, as reported by both the Federal Reserve Bank of St. Louis and the Federal Reserve Bank of New York. Furthermore, FICO discloses the average credit card balance in June increased by 6.5% from the previous year, standing at $2,573. Alarmingly, there's a 42.6% surge in accounts overdue by one cycle over the past two years, reaching its peak since September 2017.

More Than Half of U.S. Small Business Owners Believe the Economy Is Already in a Recession

More Than Half of U.S. Small Business Owners Believe the Economy Is Already in a RecessionAug 22, 2023 - 06:19:37 PDT

Over half of U.S. small business owners perceive the economy to be in a recession, according to a recent survey by the National Federation of Independent Business. This pessimistic view persists, even though some businesses report stable financial conditions. While there are signs of economic vigor like strong retail sales, the sentiment is overshadowed by lingering concerns. The aftermath of significant bank collapses earlier in the year still weighs on confidence. Moreover, the Federal Reserve's aggressive rate hikes since March 2022, raising borrowing costs, exacerbate concerns for many enterprises.

It’s no secret that China’s meteoric rise has completely shifted the global economic landscape... But how did we get here?