Gold has all the potential to go unprecedentedly high. But silver will be gold on

Site:

Precious metals news

U.S. banks, facing stringent regulations and the impact of rising interest rates, are offloading risk by selling complex debt instruments known as synthetic risk transfers to private funds. This strategy helps banks mitigate regulatory capital charges and is attractive to investors seeking high returns. However, this move indicates a deeper shift on Wall Street, with private credit firms increasingly influencing the finance sector and assuming roles traditionally held by banks. These practices, reminiscent of pre-2008 crisis mechanisms, raise concerns about the potential for systemic risk in the financial system.

Nov 8, 2023 - 05:18:05 PST

Big banks are grappling with $650 billion in unrealized losses due to the Treasury market's downturn, mirroring the conditions that led to Silicon Valley Bank's collapse. These losses, if realized, could threaten financial stability, raising alarms over potential systemic risks. Bank of America is notably exposed, with a $130 billion shortfall. While the losses are paper-based for now, they loom over Wall Street, with bank stocks suffering and fears of another crisis simmering.

ALL SILVER MINERS SUFFER LOSSES EXCEPT ONE, Q3 2023 UPDATE: Silver Mining Industry Struggling With High Costs

ALL SILVER MINERS SUFFER LOSSES EXCEPT ONE, Q3 2023 UPDATE: Silver Mining Industry Struggling With High CostsNovember 8, 2023

With the Q3 Earnings now in, All of the Silver Mining Companies we analyze, but One, suffered losses. While this is not good news for the silver miners as they provide a "High-quality Asset" in a world drowning in massively inflated financial assets... I see this changing in the future...

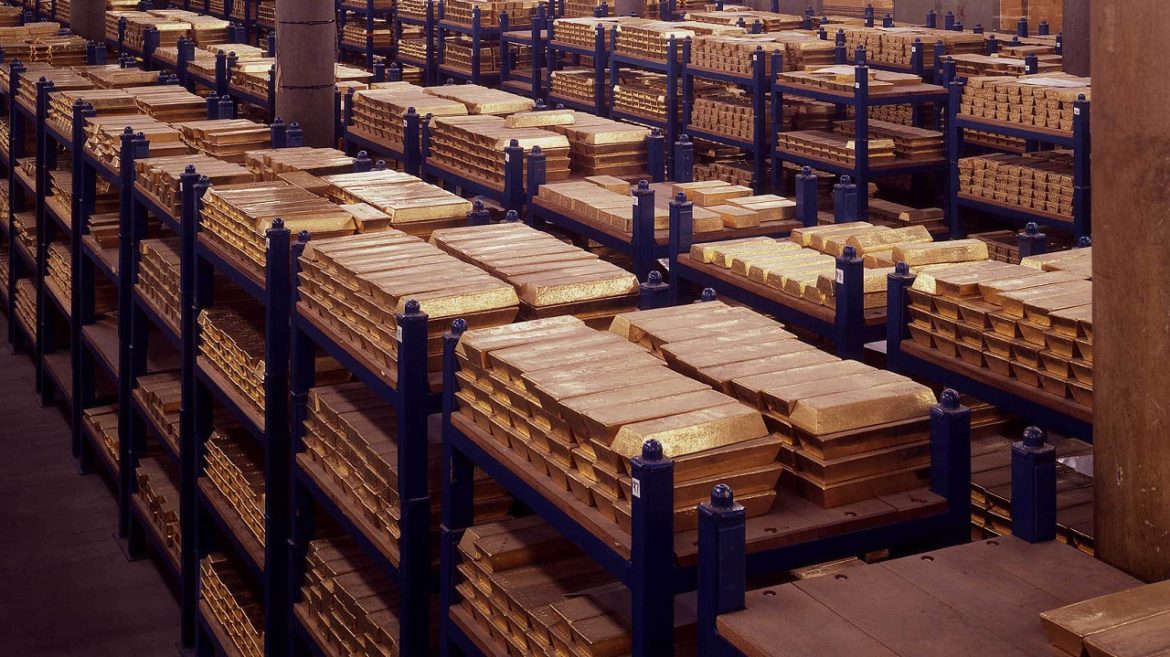

Central banks have amassed 800 metric tons of gold in the first nine months of 2023 to counter inflation and lessen US dollar reliance, marking a 14% increase from last year. China leads the pack, adding 181 tons to its reserves, while its consumers also flock to gold amid economic uncertainty. This robust central bank demand, defying a stronger dollar and higher bond yields, which typically dampen gold's allure, has propped up its price. Gold's appeal remains resilient, potentially pushing its market value towards record highs.

Government's Financial Ponzi Strategy at Risk of Collapse Under Interest Rate Pressure

Government's Financial Ponzi Strategy at Risk of Collapse Under Interest Rate PressureNov 7, 2023 - 11:50:38 PST

Rising interest rates are rupturing the global bond market's extended period of falling yields, with the U.S. ten-year Treasury yield jumping from 0.5% to 4.8%. Central banks' attempts to control inflation, partly of their own making, have backfired, leading to an investor exodus from U.S. debt amid soaring national deficits. The world braces for the economic fallout, with recessions looming as the reality of a debt-fueled Ponzi scheme comes to light. With no solution in sight, the only expectation is a future of devalued currency and persistent inflation.

Iowa's Citizens Bank has collapsed, saddled with $15 million in concealed loan losses. Not FDIC-insured, the fallout is Iowa's to shoulder. This debacle is the year's sixth, pointing to a dire trend in banking stability. Amidst fleeting government fixes, the reality is stark: more failures loom, and for those hedging against systemic risk, gold increasingly appears as a solid refuge.

Retail job cuts have spiked to 72,182, the highest since 2020, outpaced only by the technology sector's layoffs. U.S. retailers are slashing jobs at an alarming rate, up 258% from last year, even as they enter the critical holiday season. Despite a slight decrease in overall U.S. job cuts in October, the trend remains upwards from last year, indicating a troubling labor market in the retail industry.

U.S. household debt rose this month, led by increases in mortgages at $12.14 trillion, credit card debt at $1.08 trillion, and student loans at $1.6 trillion. Post-Great Recession, economic analysts focus closely on household liabilities. The New York Federal Reserve issues a quarterly Household Debt and Credit report, tracking this data since 2003. This report draws from the NY Fed's Consumer Credit Panel, a sample of over 40 million individuals' credit reports provided by Equifax.

Nov 7, 2023 - 07:46:28 PST

Macro Investor Luke Gromen predicts the U.S. will inevitably resort to printing more money as cutting entitlements or defense spending is politically unlikely. He suggests that, faced with rising debt and limited options, the government will choose quantitative easing over default, despite the risk of significant inflation. Gromen foresees this environment as favorable for assets like gold, oil, and Bitcoin.

Mike Maloney and Alan Hibbard delve into a fascinating legal dispute that pits the US Federal Reserve against Bitcoin magazine.

The US's soaring debt interest payments, now over $1 trillion and consuming 16% of the federal budget, signal a grim fiscal outlook. This spike in debt servicing costs could prompt a bond market backlash and has already led to a Fitch Ratings downgrade. With high deficits and substantial refinancing ahead, the US fiscal situation is increasingly precarious.

Central banks continued to gobble up gold.Reported central bank gold reserves expanded by a net 77 tons in September with nine countries buying a ton or more.

Nov 7, 2023 - 06:07:13 PST

Tuesday's market outlook is bleak as oil dips and stock futures wane in reaction to China's weak export data. Echoing these concerns, Bridgewater's Bob Prince warns of the enduring burden of the U.S. government's soaring debt, which poses long-term rollover risks and global vulnerability. The debt-fueled boom in private equity is hitting a wall, with rising interest rates causing liquidity crunches and a slowdown in transactions. Citigroup analysts underscore the danger of testing the limits of government debt, implying that such a crisis could trigger a worldwide retreat from risk assets.

Gold prices dropped to a near two-week low due to a stronger dollar, as the market anticipates interest rate directions from upcoming Federal Reserve speeches. Spot gold fell 0.5%, and gold futures declined 0.8%. The dollar's rise makes gold costlier for international buyers. Investors are now focused on Fed Chair Jerome Powell's upcoming addresses for potential rate insights.

U.S. housing is at its least affordable since 1984, with record-high monthly payments due to 23-year peak mortgage rates. The typical home payment consumes 41% of household income, well above the historical average. Significant mortgage rate drops, income increases, or price reductions would be needed to improve affordability.

Minneapolis Fed President Neel Kashkari asserts that the fight against inflation isn't over, indicating readiness for further rate hikes if needed. Despite recent stable rates, Kashkari remains cautious, emphasizing the need for more economic data to determine future actions. He notes ongoing economic strength, suggesting no immediate rate cuts are on the table until inflation significantly slows.

Foreign companies are withdrawing profits from China, with over $160 billion taken out over six quarters through September, marking a shift in foreign investment patterns as growth slows and U.S.-China tensions rise. This has led to China experiencing net foreign direct investment loss for the first time in 25 years, contributing to the depreciation of the yuan and reflecting concerns over geopolitical risks and the attractiveness of financial returns elsewhere.

Emerging markets are facing a severe debt crisis due to high US interest rates and a strong dollar, with 23% of these countries paying borrowing costs over 10 percentage points higher than US rates, up from less than 5% in 2019. This has pushed their debt service costs to the highest levels since 2010, leading to defaults in countries like Ghana and Sri Lanka and leaving others on the edge. High borrowing costs are squeezing economies, reducing access to international finance, and forcing governments to adopt austerity measures, which may stifle economic growth and exacerbate fiscal deficits.

The Eurozone economy is in a deep slump, with key PMI indicators signaling contraction. Despite energy price drops and ample stimulus, growth is absent, hindered by central planning and inefficient allocation to unproductive sectors. High government spending and regulatory costs, especially in energy, undermine competitiveness. The ECB's challenge is not inflation versus growth, but choosing between stagnation and stagflation amid government pressure to maintain easy monetary policies.

President Biden keeps saying the economy is great. Fed officials say the economy is expanding at a "strong pace."Peter Schiff isn't buying the narrative.He says we may already be in a recession and he made a strong case in his podcast.