Gold has all the potential to go unprecedentedly high. But silver will be gold on

Site:

Precious metals news

At SchiffGold, while there are areas of disagreement with Warren Buffett's right-hand man, the late Charlie Munger, his nuggets of wisdom, often referred to as ‘Mungerisms,' hold considerable weight in the financial world. Covering topics from wealth and happiness to avoiding foolish mistakes, Munger's insights are diverse.

IMPORTANT INDICATOR: Gold Mining Shares Per Gold Oz Ratio... How High Or Low A Gold Stock Is Based On Gold Price

IMPORTANT INDICATOR: Gold Mining Shares Per Gold Oz Ratio... How High Or Low A Gold Stock Is Based On Gold PriceFebruary 21, 2024

What are the "Most Expensive & Cheapest" Gold Mining shares compared to the gold price?? Also, this indicator shows us when is a better time to acquire the gold mining shares and when is a better time to sell. I analyze the Top 6 Gold Miners in this video update...

Inflation No Match for Casino Wins: U.S. Gaming Industry Sees Historic Highs in 2023

Inflation No Match for Casino Wins: U.S. Gaming Industry Sees Historic Highs in 2023Feb 20, 2024 - 11:19:38 PST

U.S. commercial casinos hit a jackpot in 2023, raking in $66.5 billion from gamblers, the industry's most lucrative year to date. This figure represents a significant 10% increase over the previous record set in 2022, an impressive feat considering the economic challenges of the time, including persistent inflation affecting everyday costs like groceries and energy. According to the American Gaming Association, this surge reflects an unprecedented demand for gaming, spanning both traditional casino floors and online platforms. Even the holiday season, typically a time when consumers tighten their belts, saw record-breaking casino wins in December and the final quarter of the year, further emphasizing the robust appetite for gambling among American adults.

Cash's Comeback: Investors and Corporates Bet Big Despite Rate Cut Delays

Cash's Comeback: Investors and Corporates Bet Big Despite Rate Cut DelaysFeb 20, 2024 - 11:18:15 PST

Despite predictions of its demise earlier this year, cash remains a powerhouse in the financial landscape. As the Federal Reserve postpones interest rate cuts, a robust influx of investment is evident in money-market funds, with investors adding a staggering $128 billion since the year's start. Corporate treasurers are also on a cash accumulation spree, holding a record $4.4 trillion by the end of the third quarter. This trend is further amplified by the market's seamless absorption of over $1 trillion in Treasury bills since mid-2023, signaling not just the resilience but also the potential for further growth in cash holdings.

Leading Economic Index No Longer Predicts U.S. Recession -Conference Board

Leading Economic Index No Longer Predicts U.S. Recession -Conference BoardFeb 20, 2024 - 10:56:22 PST

For the first time since the summer of 2022, the Conference Board's Leading Economic Index (LEI) no longer forecasts an impending U.S. recession, despite a continuous decline over the past 23 months. In January, the LEI fell 0.4% to 102.7, marking its lowest point since the brief recession in April 2020 triggered by COVID-19 and subsequent lockdowns. This change in outlook is attributed to positive contributions from six of the index's ten components over the last six months, signaling a shift away from recession predictions. However, expectations for economic growth in the second and third quarters remain subdued, with projections close to zero, indicating a stagnating economy rather than a contracting one.

The Federal Reserve's journey towards achieving a 'soft landing' for the economy may be bolstered by a remarkable surge in productivity witnessed in the post-Covid era. Wall Street economists are optimistic that the trend of high productivity growth, which has seen an average increase of 3.9% over the last three quarters — a rate more than triple that of the decade before the pandemic — will persist. This productivity boost allows companies to increase wages without raising prices, potentially easing inflation concerns and allowing for a more lenient monetary policy stance.

In January 2024, U.S. retail and food service sales saw a modest increase to $700.3 billion, marking a 0.6% rise from the previous year, according to Census Bureau data. This uptick in consumer spending has contributed to a significant rise in household debt, reaching $17.5 trillion in the fourth quarter of 2023, as reported by the Federal Reserve of New York. While increased consumer debt is a concern, the surge in spending is a positive indicator for the economy, given that consumer expenditure plays a vital role in the nation's Gross Domestic Product (GDP). Economists, including Christopher Rupkey of FWDBONDS in New York, view this trend as a sign of economic strength, potentially obviating the need for recession forecasts and suggesting a balanced economic climate that could justify interest rate cuts in 2024.

Over the last four years, the U.S. economy has experienced a rollercoaster of events, starting with a devastating pandemic that led to a financial market crash and economic downturn. This was followed by a period of spiraling inflation and rapidly increasing interest rates that put significant pressure on households and industries alike. Surprisingly, the economy has emerged from these challenges stronger, with stock markets reaching record highs and a recession seemingly averted. Despite these positive indicators, the path that led to this recovery remains a mystery, and the future of the U.S. economy in 2024 is shrouded in uncertainty.

Feb 20, 2024 - 07:29:01 PST

Argentina's President Javier Milei has reignited discussions about adopting the U.S. dollar to reignite the Argentina economy, mirroring the monetary strategy of Panama, Ecuador, and El Salvador. This significant shift aims to stabilize Argentina's economy by potentially curbing inflation and fostering economic stability, leveraging the precedent set by these countries. Through this proposed change, Argentina seeks to address its long-standing economic challenges by integrating a more stable and widely accepted currency, which could have profound effects on inflation rates, investment flows, and overall economic confidence.

Gold prices have remained relatively stable in recent trading sessions, dropping below $2,000/oz briefly, before climbing back above $2,030/oz. Despite a U.S. market holiday contributing to limited trading cues, gold has shown resilience, bouncing back from a two-month low to hover around the $2,000 to $2,050 an ounce mark through much of 2024. This stability comes as geopolitical tensions in the Middle East and between Russia and Ukraine offer some support to gold's value.

The most direct way to invest in gold is to buy gold and as SchiffGold advises the smart way to buy gold is to buy gold coins or billions. Sometimes investors bullish on the long-term prospects of gold take a look at the stocks of gold mining companies. Stocks of course lack some of the most attractive features of gold such as physical portability, and its finite amount (stocks always be diluted). Plus, mining companies can go bankrupt and are at greater risk from new regulations.

Mike calls it the greatest theft in human history.

Inflation, Growth, and Labor Data Heat Up, But Wall Street Stays Skeptical

Inflation, Growth, and Labor Data Heat Up, But Wall Street Stays SkepticalFeb 20, 2024 - 07:07:23 PST

Despite economic data indicating that the U.S. economy might be improving, with indicators like inflation, economic growth, and labor market strength showing higher-than-expected figures, Wall Street is responding with a dose of skepticism. Economists are tempering reactions to these reports, suggesting that the apparent surge in numbers could be attributed to seasonal adjustments and unique factors at the year's start rather than a sustained trend. This view highlights the ongoing debate about the economy's direction and the challenge of interpreting data in a complex and shifting financial landscape.

The Road to $3,000 Gold: Citi Analysts Eye Central Bank Moves and Global Economic Trends

The Road to $3,000 Gold: Citi Analysts Eye Central Bank Moves and Global Economic TrendsFeb 20, 2024 - 06:26:30 PST

Citi analysts predict a potential surge in gold prices to $3,000 per ounce and oil to $100 per barrel in the next 12 to 18 months, driven by three key catalysts: a significant increase in central bank purchases of gold, the onset of stagflation, or a deep global recession. Gold's price, already at $2,016, could rise by approximately 50% due to these factors. The analysts highlight "de-dollarization" in emerging market central banks as a primary catalyst, which could lead to a crisis of confidence in the U.S. dollar and significantly boost gold purchases. This shift could challenge jewelry consumption as the dominant force in gold demand, marking a significant change in the market dynamics of gold.

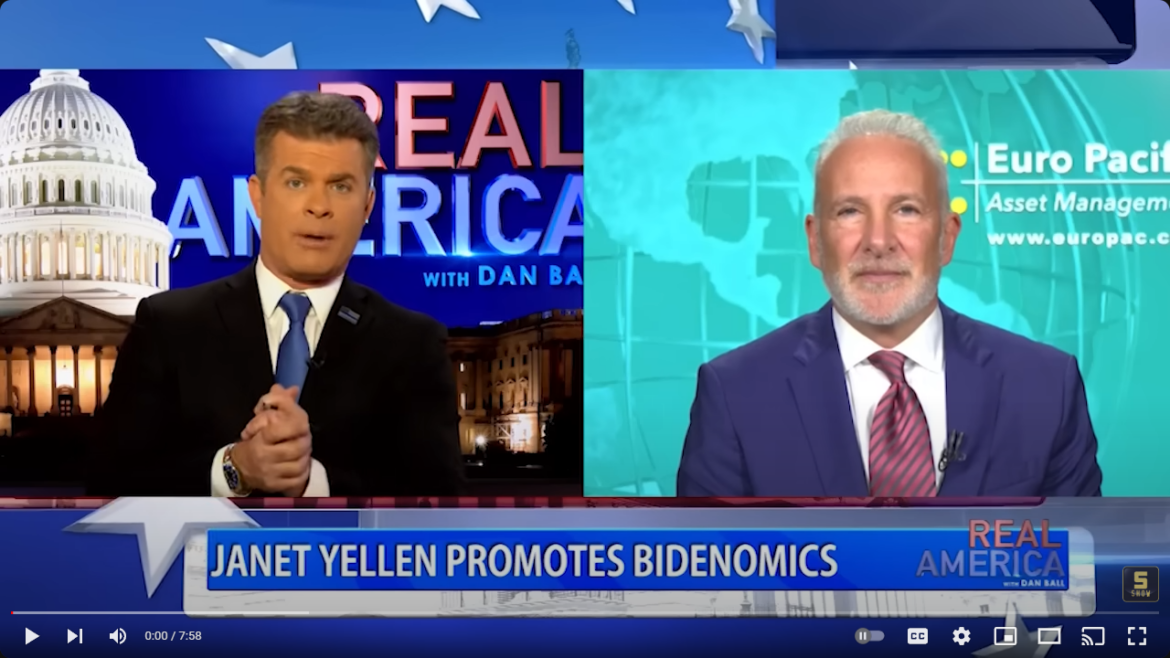

In a recent interview, Peter Schiff was featured on Real America with Dan Ball.

On Super Bowl Sunday, President Biden took to X (formerly Twitter) to skewer consumer brands for “shrinkflation,” a phenomenon where product vendors reduce package sizes without proportionally reducing price, in what essentially amounts to a per unit cost increase for consumers. The video explicitly calls out popular snack brands such as Breyers, Gatorade, and Tostitos— all food products that are likely on the top of consumers’ minds when thinking of inflation.

Can America hope to climb past its mountain of $34 trillion of federal debt? With the staggering weight of unfunded liabilities in vital entitlement programs like Social Security and Medicare reaching a staggering $212 trillion, any strategy for repayment is met with formidable obstacles. Our guest contributor examines these challenges and arrives at a sobering verdict: the magnitude of the debt renders the prospect of repayment virtually impossible. While clearing the debt may be beyond reach, the US can still take decisive action to rein in spending and prevent further exacerbation of its dire financial predicament.

METALS & ENERGY MARKET UPDATE FEB 18th: Hyper-inflated Stock Market Continues While Energy & Commodities Remain O...

METALS & ENERGY MARKET UPDATE FEB 18th: Hyper-inflated Stock Market Continues While Energy & Commodities Remain O...February 18, 2024

Investors continue to ignore energy, metals, and the mining industry as the U.S. Stock Market becomes more concentrated with the largest stocks. However, this will rotate back the other way as investors realize they must protect their wealth as we hit the ENERGY CLIFF...

Credit Markets Show Unwavering Strength Amid Rising US Inflation Concerns

Credit Markets Show Unwavering Strength Amid Rising US Inflation ConcernsFeb 16, 2024 - 12:19:05 PST

Despite unexpectedly high U.S. inflation rates challenging the outlook for imminent Federal Reserve rate cuts, the credit markets remain robust, buoyed by a substantial influx of investment. This surge of capital into the credit market has effectively cushioned investors against potential downturns, including the diminishing likelihood of central bank rate reductions this year. On Tuesday, despite the inflation surprise, risk premiums on both high-grade and junk bonds dropped, and a key measure of default insurance barely ticked higher than the previous day's levels. This resilience is largely attributed to the continuous flow of funds into credit investments, leaving managers with ample cash to deploy.